8 - Blocks

8.1 - Order Block (OB)

8.1.1 - OB Definition

- Order blocks are refined areas or candles inside supply or demand (SD) zones.

- Order blocks usually form when liquidity pools are found. It potentially indicates the pile-up of orders from institutions and banks.

- After the formation of the order block, the market will make an impulsive move.

8.1.2 - OB Validity

8.1.2.1 - Core Validation Principles

To consider an order block as valid, the impulsive move originating from it must satisfy the following conditions:

- Liquidity Grab (LG): The impulsive move should occur after a liquidity grab.

- Fair Value Gap (FVG) or Volume Gap (VG): The impulsive move must create either a Fair Value Gap (FVG) or a Volume Gap (VG).

- Clear Displacement in Price Action: The impulsive move should exhibit clear displacement and inefficiency in price action.

- Break of Structure (BoS) or Change of Character (CHoCH): The impulsive move should result in either a Break of Structure (BoS) or a Change of Character (CHoCH).

8.1.2.2 - Additional Validation Pricinples

To consider an order block as strong and not only valid, the impulsive move originating from it must satisfy the following conditions:

- Engulfing Bar: The impulsive move must include at least one engulfing candle.

- Boring Candle: The order block itself should feature at least one boring candle. A boring candle is defined as a candle with a body that constitutes less than 50% of the candle's total size. This suggests a period of market indecision, which can be advantageous for the strength of the order block (OB).

- Volume Profile Extreme Node: Examine the volume profile to see if the order block (OB) aligns with either a major high-volume node or a major low-volume node. If it does, this significantly strengthens the validity of the order block (OB).

- Inducement: After the impulsive move, identify an inducement level or liquidity pool that can be swept before reaching the order block. In other words, the likelihood of the order block (OB) holding increases when price action first captures liquidity before reaching the order block.

- Deceleration: It's crucial for the price action to show signs of deceleration before it reaches the order block (OB). This deceleration increases the chances that the OB will hold when tested.

- Analyze the currency index of the pair you are trading and scan for additional confluences that may support your trade idea.

8.1.3 - OB Drawing Methods

- Take the whole opposing color candle with its wick before the move.

- When applicable, extend the order block box to cover the swing low/high before the move.

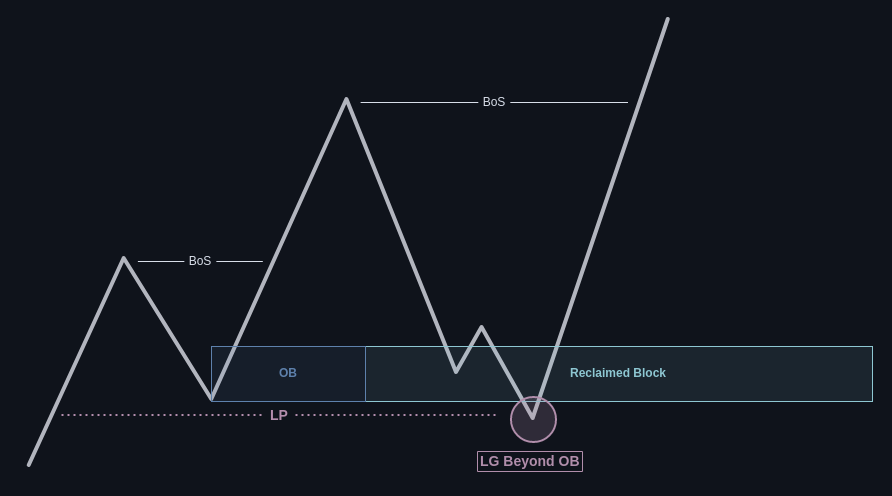

8.2 - Reclaimed Block (RB)

A Reclaimed Block (RB) represents a nuanced category of an order block that embodies a supply or demand zone which has briefly faltered in sustaining its function as a market support or resistance level. This occurrence is characterized by price action momentarily breaching a valid order block, denoted by a wick or several minor candles, before promptly reverting to its initial trajectory. When this reversal reinstates the order block's function as a supply or demand barricade, it earns the designation 'reclaimed,' signifying its transient lapse followed by a recovery of its pivotal market role.

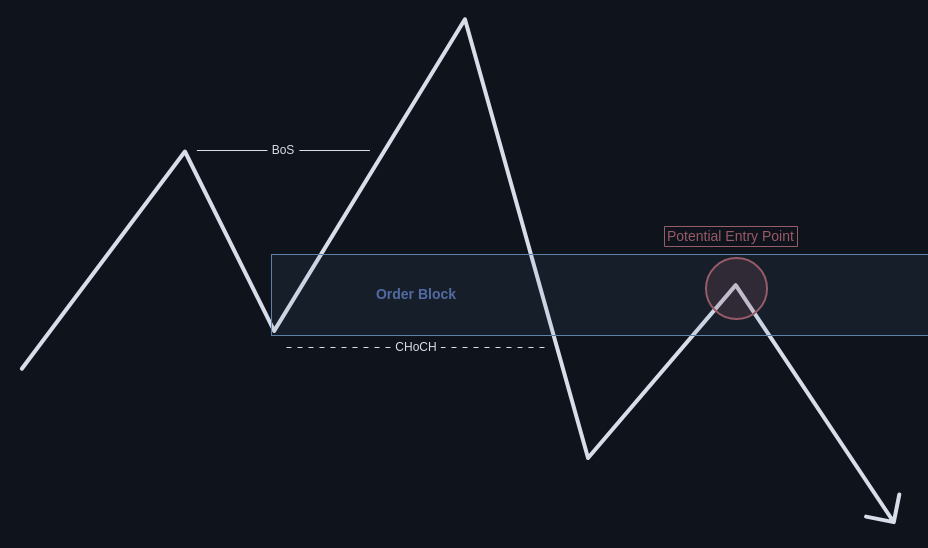

8.3 - Breaker Block (BB)

A Breaker Block (BB) is a specialized form of an order block, specifically either a supply or demand zone, that has notably failed to maintain its role as a support or resistance level in the market. Unlike traditional order blocks that effectively act as barriers, guiding the price action either upwards or downwards, breaker blocks lose this defining characteristic. However, their significance is not diminished; rather, they evolve to serve as potential future entry points for traders, but only after a careful confirmation of the prevailing trend direction.

- Breaker Blocks are more likely to hold when overlapped by a Fair Value Gap (FVG), even if only partially.

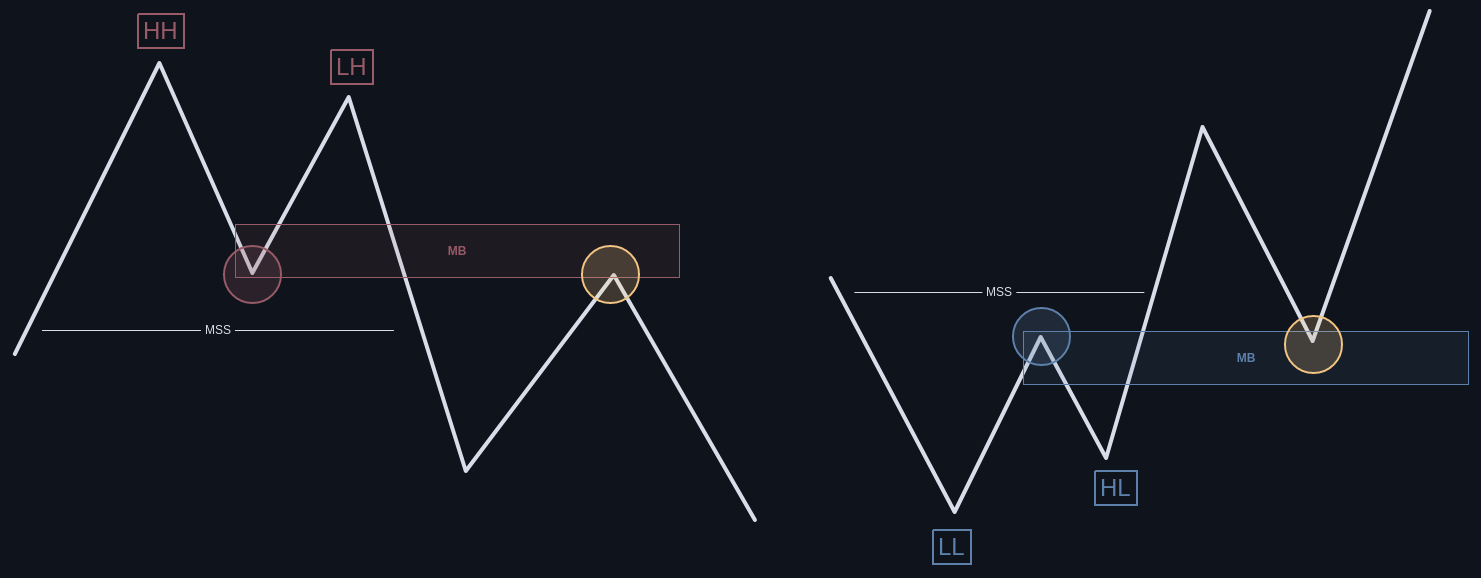

8.4 - Mitigation Block (MB)

A Mitigation Block (MB) is a range or an up/down close candle in the most recent swing low/high that fails to take out a swing high/low. The traders who bought/sold at this level will look to mitigate their losses when the price return back to the block.

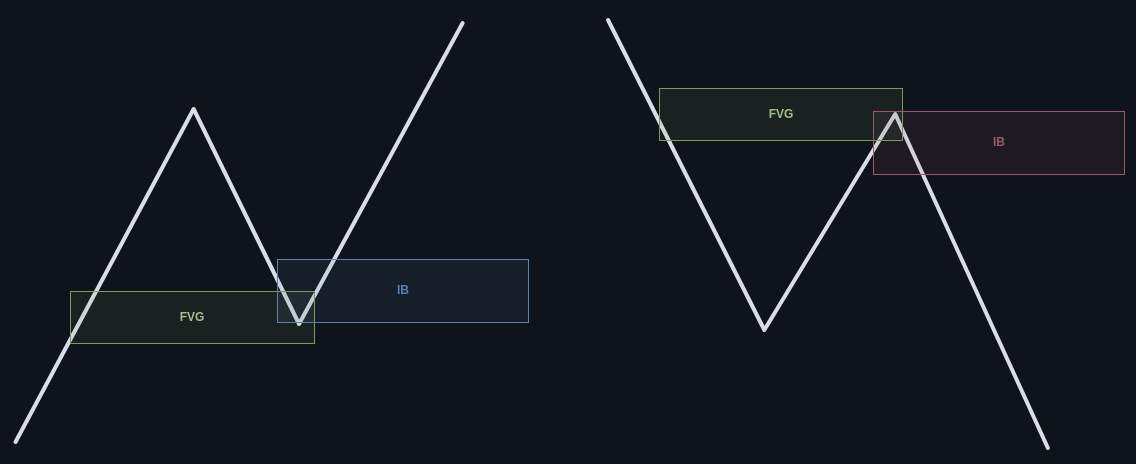

8.5 - Imbalance Block (IB)

The Imbalance Block (IB) is an order block that emerges after an imbalance or a Fair Value Gap (FVG) is filled. This block partially intersects with the filled FVG. When revisited, price action often exhibits a pronounced reaction to the IB, emphasizing its significance as a robust order block.